For a few months now, we have been beginning to read articles that seem to re-propose the importance of certain technologies that have been much talked about until now. Among these, of course, is artificial intelligence…

What is happening

Enthusiasm in technology is something wonderful but, on balance, it does not contribute to the consolidation of technological solutions. Enthusiasm allows us to get to know them in many ways, to see their merits and flaws, but it has nothing to do with actual use, real utility and actual adoption.

After an initial great moment of enthusiasm related to artificial intelligence, we are now beginning to speak more and more frequently of a ‘bubble’, and the same applies to other technologies that, in theory, should have been established as widespread. It is worth mentioning an excellent article published by Wired Italia by Andrea Daniele Signorelli and entitled‘Nvidia, OpenAI and the artificial intelligence bubble‘.

What if this bet turns out to be a loser? In a nutshell, this is the fear that is beginning to circulate: that Nvidia, Meta, Microsoft, OpenAI (which we will come back to later) and all the others in the industry have staked immense amounts of money on a future that may never happen. “The huge spending in the field of artificial intelligence has not been justified so far, given the limited applications of this technology,” said JPMorgan analysts.

And indeed, the same perplexities had been raised on this blog when, examining the energy demands of A.I., one wondered how widespread use of such technology was necessary in the face of such consumption. The same Wired article quoted above, referring to the Elliot Management Corporation investment fund’s phrases on artificial intelligence states:

They will never be cost-effective, never work as expected, always require too much energy or prove unreliable

As of 30 June 2024, the investment fund Elliot Management Corporation managed approximately USD 69.7 billion in assets and is considered a very reliable entity in financial and market analysis.

The bubble

In finance, there is a theorem called‘expected utility theory‘, which Wikipedia reports as follows:

Expected utility theory is based on the assumption that an agent’s utility under conditions of uncertainty can be calculated as a weighted average of the utilities in each possible state, using as weights the probabilities of the occurrence of the individual states as estimated by the agent.

The relevant aspect of this theorem is that, among other uses, it is also used to understand where to invest, which, for all intents and purposes, is useful in understanding the bubble phenomenon. The consolidation of a technology is not given by its spectacularity or its apparent media popularity, but by its ability to be applicable in multiple contexts, in a regime of sustainability. To propose a technology that is powerful but drains the energy resources of an entire city is to present something that is unsustainable and therefore unusable if not downright harmful.

Blockchain and Bitcoin

There has been a battle going on for years over the usefulness of blockchain and the soundness of bitcoins. So far, the market has established one truth: the blockchain has established itself thanks mainly to bitcoins, which have reached a considerable economic value. This is undeniable and to do so would be to reject a quantitative fact: that 1 bitcoin is currently worth EUR 54,230.22. (15/09/2024 11:50) A frightening exchange rate. Yet for months people have been going on about the bubble ‘s imminent and imminent demise, arguments to which cryptocurrency investors have become accustomed. Articles such as Milano Finanza‘s‘Bitcoin, for the ECB it is just a speculative bubble. The Etf does not change the substance: crypto is not suitable as an investment method‘ or like that of Corriere delle Comunicazioni‘Bitcoin, the ECB: “Only a speculative bubble, paper castle will collapse“‘.

And in this war between opinions and data, which is legitimate and interesting, a doubt remains: in which other areas has blockchain established itself? It should have asserted itself widely in every sector of people’s economic life: financial transactions, commercial relations, but to date there are very few projects, although in some cases well implemented (there are very successful cases of smart contracts). A few high schools have tried to adopt blockchain from some vendors to mark maturity degrees but basically the marriage with this technology has been turbulent to say the least. The reason is simple: it consumes too much energy (the case of proof-of-work) and that is why alternative systems such as proof-of-stake have been designed and implemented ( I recommend this sample video for further study) but with big problems yet to be solved. The road is long and far from being as trivial as many techno-enthusiasts had originally assumed.

Artificial Intelligence

Agenda Digitale, the renowned electronic magazine on technology and beyond, published an interesting article in June 2024 by Prof. Umberto Bertelè entitled‘AI, the first big doubts about the super boom‘. The abstract of the article contains one of the most well-known problems of this fast-growing phenomenon:

The stock market continues to focus on generative AI, with big tech companies increasing their investments. However, the international business press expresses scepticism about the returns for investors. US antitrust authorities investigate major tech companies. Meanwhile, new AI applications emerge, pioneered by a growing number of start-ups.

Artificial intelligence today is having a very dystopian growth: the masses use it to create real life artefacts (photos, videos, audio) while very few actually handle ‘big data’ for research purposes. Is therefore all the energy consumption generated by such processing justifiable or would it be more appropriate to restrict it to really necessary cases?

Electric cars

Another glaring example of a potential bubble is the one related to electric cars that former Ferrari CEO Sergio Marchionne spoke about many years ago. It was 2017 when Marchionne spoke, in a non-enthusiastic but pragmatic way, about the technological evolution linked to electric cars. He was treated to many articles, including a very effective one in La Stampa by Francesco Spini.

The limitations of electric cars are not just about cost, autonomy, recharging times or refuelling. There is a much more important element that is almost never considered: their environmental impact throughout their life cycle, especially with regard to the source from which electricity is derived. Energy is produced from fossil fuels that are, at best, equivalent to a petrol car.

In recent months, interest in hydrogen-powered cars has been growing, and in other countries (e.g. France) they are already receiving substantial investment; one example is undoubtedly the one described in the article‘Opens SymphonHy, the first gigafactory for the production of hydrogen fuel cells‘ published in Quattroruote magazine by Claudio Todeschini.

A phenomenon announced (or not?)

The technological imposition caused by communication and marketing departments does not produce progress but risks creating bubbles that are difficult to maintain. Technology needs realistic application scenarios and, above all, time to find sustainability, which in many cases is underestimated. Should one infer that time is against profits? This is a not too obvious question, unfortunately. Profit, which depends on the quantity(q) sold, is the difference between the total revenue(RT) and the total cost(CT) of production1:

P (q)= RT(q) – CT(q).

The time factor is not clearly expressed in the formula, but it is implicitly included in the profit formula. The total cost is clearly inclusive of the time factor. Time is a very important element of consolidation because, although it can cause a slowdown in the volume of profits in the short term, it can also lead to a longer life of the proposed solution.

It is therefore necessary to make a careful assessment of technologies when they come onto the market and patiently evaluate their actual sustainability in relation to environmental, economic and utility phenomena. Yet not everyone agrees on the existence of this‘bubble‘, Forbes magazine in June 2024 had released an article with the unequivocal title‘Are we facing a tech stock bubble? The indicators say no‘

The article inside is particularly explicit in this regard, explaining that corporate stocks continue to be optimal and that this is sufficient as a ‘litmus test’ of the health of tech stocks.

This market trend has stimulated debate among investors and analysts: are we in the presence of a new technology bubble? The answer is that, at the moment, there are no signs of it.[…] Moreover, one can observe today that the growth of technology stock prices is generally accompanied by a corresponding, if not even stronger, increase in profits.[…] Similarly, one does not see an increase in the propensity to engage in mergers and acquisitions among companies. The latter factor historically reaches high levels during bubble periods: to such an extent that, at the time of the Lehman Brothers crisis, M&A volume had reached almost double the average level, whereas today volumes are around or slightly above average. Finally, the level of US household debt, which in relation to gross domestic product remains at very low levels, is not a cause for concern either.

Conclusions

So is there a certain future for technologies such as AI, such as the blockchain, such as cryptocurrencies? The answer is yes but… and that future only materialises when such technologies are:

- Economically sustainable.

- Non-energy-consuming.

- Easily accessible at least by the community they address.

- Bringing technological and/or social development.

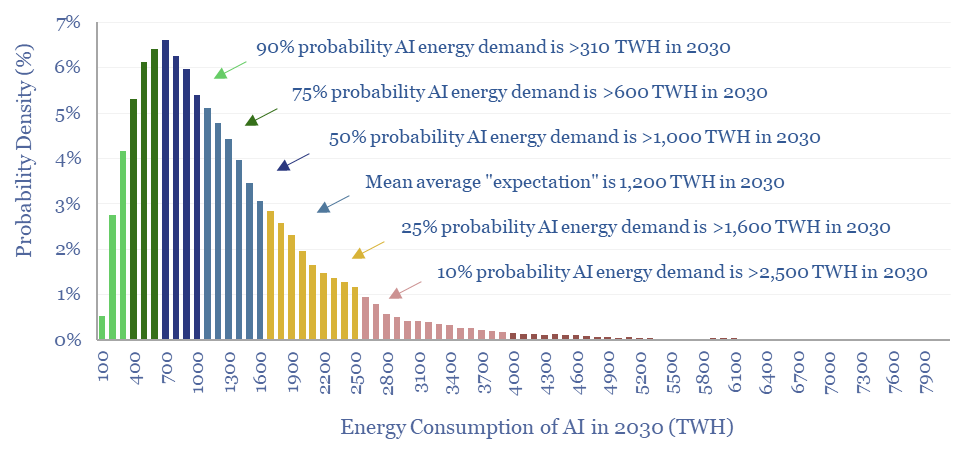

These characteristics mark the basic elements for a healthy and manageable development of technologies. According to the energy research company Thunder said Energy in 2030 the demand for energy to power AI could, with high probability, reach 310 TWH (Tera Watts per Hour).

Such consumption normally belongs to countries like Norway, Australia or the Netherlands and, instead, should be supported by a single company. The words spoken by Marchionne in 2017 therefore come back to the forefront: those that argue that before any technological innovation, the real sustainability should be carefully assessed to avoid it being a meteor or worsening global living conditions. The technologies that will remain in the service of mankind will therefore only be those that are useful and sustainable, those whose use will not cause a significant impairment of the natural and financial life cycle of human beings.